July 30, 2025: Monero (XMR), the leading privacy-centric cryptocurrency with a market value exceeding $5 billion, is contending with a major security challenge posed by Qubic, a rival blockchain project led by Sergey Ivancheglo (IOTA co-founder). Over the last month, Qubic’s mining efforts on Monero ramped up sharply, at one point commanding as much as 40% of the network’s hashrate – a level unseen in Monero’s decentralized mining history.

Monero is built around the RandomX CPU-friendly mining algorithm, intentionally designed to keep mining decentralized and resistant to ASIC hardware, supporting broad participation. Qubic, by contrast, operates a “Useful Proof of Work” (uPoW) scheme: miners supply computational work to solve real-world tasks for Qubic, and as a byproduct, simultaneously mine Monero. Profits from mining XMR are regularly converted into Tether (USDT) to support buybacks and token burns for Qubic, creating both a financial and narrative connection between the networks.

Qubic’s control rapidly escalated from just a couple percent in May to as much as 40% by mid-July 2025. The community’s alarm was well-founded: ownership of such a large share of mining power introduces clear risks to network security, including the theoretical threat of transaction censorship or a so-called 51% attack, where a single actor could modify, block, or reverse transactions. On June 28, Ivancheglo publicly announced intentions for Qubic to cross the 50% hashrate threshold for a full month beginning August 2, framing the maneuver as a demonstration of their Useful Proof of Work (uPoW) consensus system, not a malicious attempt.

Estimates by third-party analysts suggest Monero’s total daily security budget (block rewards and fees) is approximately $130,000, while Qubic’s mining outlay is a fraction of that $7,000 to $10,000 daily by some tallies, giving Qubic a large incentive to direct CPU miners toward XMR, profit, and fund its own tokenomics.

Community Response

The Monero ecosystem quickly mobilized. Independent miners and pools coordinated a boycott of the Qubic pool, leading to its collapse from as much as 40% of the hashrate to roughly 10 to 15% by late July, with Qubic dropping from Monero’s largest pool to seventh place. This pushback reflects Monero’s resilience and decentralized ethos, though the Qubic pool’s share still remains above harmless levels and community leaders warn that similar economic threats could emerge again if protocol-level defenses aren’t strengthened.

Market Signals

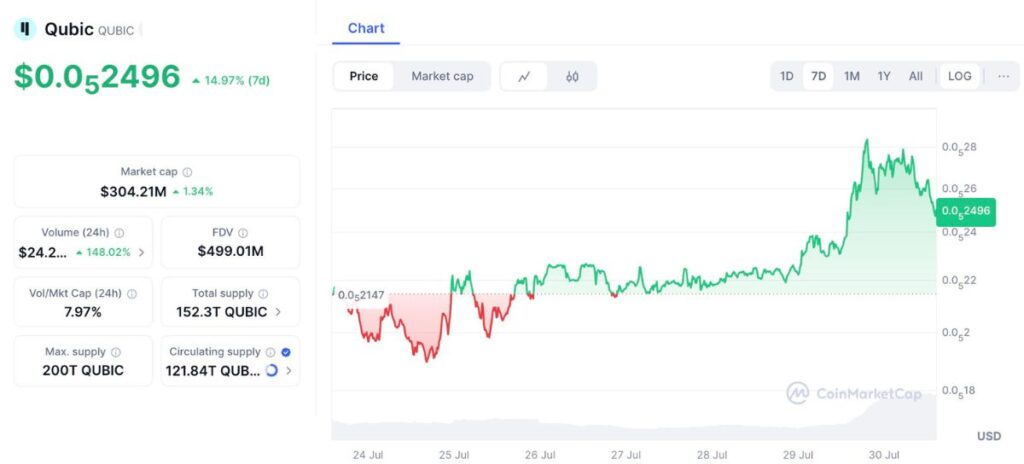

Over the past week, Monero’s price declined by about 3% (down to roughly $314 from $325), while Qubic’s token appreciated nearly 16% while demonstrating that participants are sensitive to both the risk and narrative drama unfolding between the two networks.

Motivation and Controversy

Qubic describes its campaign as a “tech demo,” not a sabotage effort. Ivancheglo and supporters argue the move is meant to expose the limits and vulnerabilities of proof-of-work systems in a public, non-malicious way, raising awareness of what might happen if a true attacker sought majority control. However, others (including leading Monero analysts and wallet developers) suggest it doubles as a publicity stunt for Qubic, generating media attention (and inflating QUBIC’s price) while revealing economic centralization risk more than a technical flaw.

Source: CoinMarketCap

Risks and Outlook

The Qubic & Monero episode reveals how even well-designed proof-of-work networks can be vulnerable if one party gains a large share of mining power, whether for demonstration or profit. While Monero’s community quickly pushed Qubic’s hashrate share down, this incident shows that economic threats & not just technical attacks can challenge network security. Going forward, Monero and similar networks may need to adopt further safeguards to prevent future hashrate concentration, recognizing that true decentralization requires ongoing vigilance and adaptability.

The ongoing Qubic episode is a real-world test of Monero’s decentralized philosophy and a timely lesson for every proof-of-work project. While the August 2–31 “demonstration” window remains ahead, the Monero community’s vigilant and coordinated response stands as the strongest defense. Whether this is ultimately remembered as an educational exercise, a marketing gambit, or an early warning about the economics of network security will depend on how both chains and communities evolve in the weeks to come.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.