How Smart Contracts Can Improve Security For Online Payments

Smart contracts are self-executing agreements with predefined terms and conditions written directly into code. They operate on blockchain platforms, typically Ethereum, and enable the automation of transactions, eliminating the need for intermediaries and enhancing security, efficiency, and transparency in digital banking.

Traditional contracts involve parties agreeing upon terms, and if one party fails to fulfill its obligations, the dispute resolution process may be lengthy and expensive. Smart contracts aim to solve these issues by automating contract execution, enforcement, and fulfillment.

Smart contracts consist of three main components: the agreement’s terms and conditions, the code that executes the terms, and the decentralized blockchain network that validates and records the transactions. Once the contract is deployed, it becomes immutable and tamper-proof, ensuring trust among the parties involved.

The automation capabilities of smart contracts offer several benefits to the digital banking industry:

1. Efficiency: Smart contracts automate processes such as verifying identities, assessing creditworthiness, and executing transactions. This automation reduces manual intervention, paperwork, and the associated time delays, leading to faster and more efficient banking operations.

2. Cost Reduction: By eliminating intermediaries, smart contracts reduce transactional costs. Parties involved in the contract interact directly, removing the need for brokers, lawyers, or other intermediaries, resulting in cost savings.

3. Transparency: Smart contracts operate on public or permissioned blockchains, enabling transparent and auditable transactions. All participants can view the contract’s terms, its execution, and the associated data. This transparency fosters trust and helps prevent fraud.

4. Security: Smart contracts leverage blockchain’s decentralized and cryptographic features, making them highly secure. Once a smart contract is deployed, it becomes nearly impossible to alter the code or tamper with the transaction records. This immutability safeguards against fraudulent activities and enhances the security of digital banking operations.

5. Programmability: Smart contracts can be programmed to trigger actions automatically based on predefined conditions. For example, a smart contract can release funds to a borrower when specific criteria are met, such as timely repayment or collateral value. This programmability enhances the efficiency and accuracy of financial processes.

6. Accessibility: Smart contracts are accessible 24/7, removing time and location constraints. Users can interact with smart contracts using compatible applications, wallets, or interfaces, enabling convenient access to financial services from anywhere in the world.

Smart contracts revolutionize digital banking by streamlining operations, reducing costs, improving security, and providing greater accessibility. They have the potential to transform various banking processes, such as payments, lending, trade finance, insurance, and compliance. However, it is important to note that while smart contracts offer numerous advantages, they also require careful coding, rigorous testing, and proper legal considerations to ensure the execution aligns with the intended outcomes and complies with applicable regulations.

Also read: Top 10 Examples Of Smart Contracts In The Real World

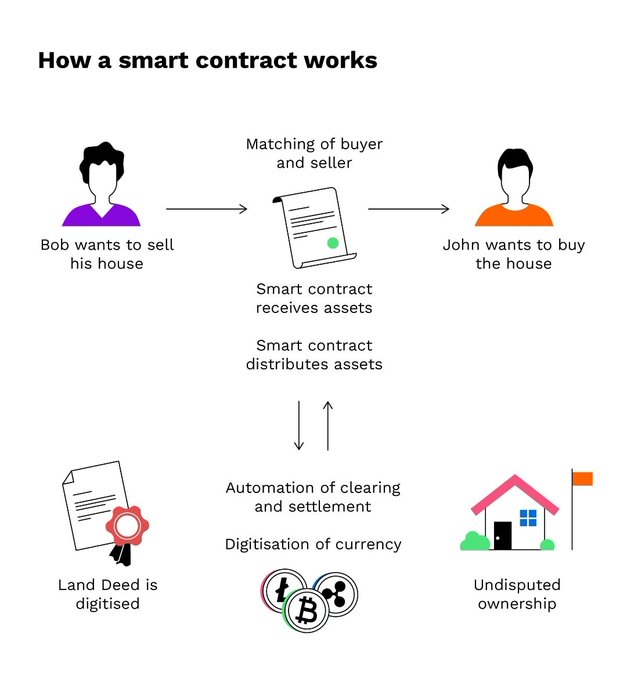

How do smart contracts work?

Smart contracts are self-executing agreements with the terms of the contract written directly into lines of code. These contracts are implemented on blockchain platforms, such as Ethereum, and leverage the decentralized and transparent nature of the blockchain to ensure their integrity and immutability.

Here’s a detailed explanation of how smart contracts work:

1. Code Execution: Smart contracts are written in programming languages specifically designed for the blockchain, such as Solidity for Ethereum. The contract code contains the rules, conditions, and logic that govern the agreement between parties. It can encompass a wide range of functions, including calculations, data storage, and interactions with other contracts or external systems.

2. Deployment: Once the contract code is written, it is compiled into bytecode, which can be executed by the underlying blockchain platform. The contract is then deployed to the blockchain, creating a new instance of the contract on the network.

3. Contract Invocation: Smart contracts can be invoked by anyone who interacts with them. This interaction is typically triggered by a transaction sent to the contract’s address on the blockchain. The transaction contains the necessary data and instructions to execute a specific function within the contract.

4. Validation: When a smart contract is invoked, the nodes participating in the blockchain network validate the transaction and execute the corresponding code. The nodes verify that the transaction adheres to the predefined rules and conditions specified in the contract. This validation process ensures that the contract is executed correctly and without any malicious intent.

5. State Changes: Smart contracts can modify the state of their internal variables or trigger state changes in other contracts or systems. For example, a smart contract representing a digital asset transfer would update the ownership records or balances of the involved parties. These state changes are permanently recorded on the blockchain and are visible to all participants.

6. Consensus Mechanism: Smart contracts rely on the consensus mechanism of the underlying blockchain to ensure agreement among network participants. In most cases, blockchain networks employ a consensus algorithm, such as proof-of-work or proof-of-stake, to validate transactions and add new blocks to the chain. The consensus mechanism prevents fraudulent or conflicting transactions from being executed and maintains the overall integrity of the contract.

7. Immutability: Once a smart contract is deployed and its code is executed, it becomes immutable. This means that the contract cannot be altered or tampered with, providing a high level of security and trust. The contract’s code and its associated state are stored on multiple nodes across the blockchain network, making it highly resistant to censorship or modification.

8. Automatic Execution: One of the key features of smart contracts is their ability to self-execute based on predefined conditions. These conditions, also known as “if-then” statements or clauses, are embedded in the contract’s code. For instance, a smart contract could specify that if a certain payment is received, a specific action should be triggered automatically. This automation eliminates the need for intermediaries and ensures that the contract is executed exactly as intended.

9. Event Notifications: Smart contracts can emit events during their execution, which can be monitored and observed by external systems or other contracts. These events serve as notifications, providing information about specific actions or state changes within the contract. External applications can listen to these events and respond accordingly, enabling the integration of smart contracts with off-chain systems.

10. Trust and Transparency: Smart contracts enhance trust and transparency by eliminating the need to rely on intermediaries and providing a verifiable record of all contract interactions. The terms and conditions of the contract are transparently defined in the code, and the execution and state changes are recorded on the blockchain for public scrutiny. This transparency reduces the potential for fraud, disputes, or misunderstandings, as all parties can independently verify the contract’s execution and outcome.

Overall, smart contracts leverage blockchain technology to create self-executing agreements with predefined rules and conditions. They automate contract execution, enhance security and transparency, and enable trustless interactions between parties, making them an essential component of decentralized applications and blockchain-based ecosystems.

Also read: How Are Smart Contracts Implemented In DApps Games? Is It Relevant?

Benefits of using smart contracts for online payments

Using smart contracts for online payments offers several benefits, revolutionizing the traditional payment systems. Here are the key advantages:

1. Automation and Efficiency: Smart contracts automate the entire payment process, eliminating the need for manual intervention or intermediaries. Once the conditions defined in the contract are met, the payment is automatically executed. This automation reduces human error, speeds up transactions, and enhances overall efficiency.

2. Cost Savings: By removing intermediaries such as banks or payment processors, smart contracts reduce transaction costs associated with online payments. There are no fees for intermediaries’ services, and the elimination of manual processes reduces administrative expenses. This cost-saving feature is especially beneficial for microtransactions or cross-border payments, where traditional systems may be expensive or inefficient.

3. Security and Trust: Smart contracts are built on the foundation of blockchain technology, which provides robust security and immutability. The decentralized nature of blockchain ensures that transactions are verified by multiple nodes, making it extremely difficult for malicious actors to tamper with payment records. The transparent and auditable nature of the blockchain enhances trust among parties involved in the payment process.

4. Elimination of Disputes and Fraud: Smart contracts operate based on predefined rules and conditions, leaving no room for ambiguity or misinterpretation. Payment terms and conditions are explicitly written into the code, and the contract self-executes when those conditions are met. This feature reduces the possibility of payment disputes and minimizes fraudulent activities, as transactions are executed securely and transparently.

5. Real-Time Settlement: Traditional payment systems often involve delays in settlement, requiring additional time for verification and clearance. In contrast, smart contracts enable near-instantaneous settlement of payments. Once the contract conditions are met, the payment is immediately executed, providing real-time settlement and reducing the time and complexity associated with traditional payment processes.

6. Global Accessibility: Smart contracts are not bound by geographical limitations, enabling seamless online payments across borders. As long as participants have access to the blockchain network, they can engage in transactions using smart contracts. This feature opens up new opportunities for businesses and individuals, particularly in underserved regions with limited access to traditional financial services.

7. Programmability and Flexibility: Smart contracts offer a high degree of programmability and customization. The contract code can be tailored to meet specific payment requirements, allowing for complex payment scenarios. For instance, contracts can include multi-signature requirements, escrow arrangements, or conditional payments based on external data sources. This programmability enables the implementation of sophisticated payment workflows and enhances flexibility.

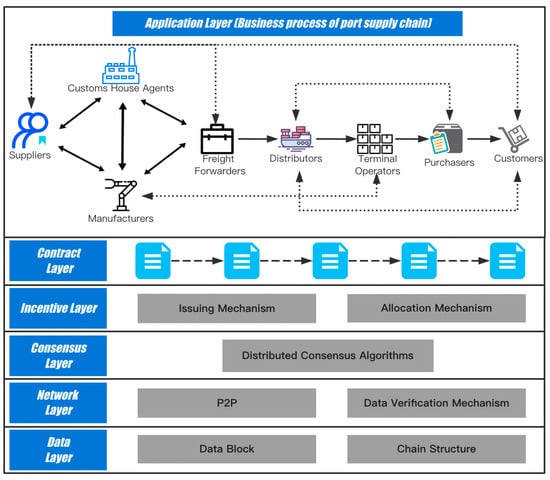

8. Integration with Other Systems: Smart contracts can seamlessly integrate with other decentralized applications and systems. This interoperability allows for the development of comprehensive ecosystems where payments can be linked to other functionalities, such as supply chain management, identity verification, or decentralized finance (DeFi) applications. This integration capability opens up new possibilities for innovative payment solutions.

9. Auditability and Compliance: Smart contracts provide a transparent and auditable record of all payment transactions. The blockchain stores a permanent and immutable history of payments, enabling easy auditing and compliance verification. This feature is particularly valuable in industries with stringent regulatory requirements, as it simplifies compliance processes and reduces the risk of non-compliance.

By harnessing the power of blockchain and automation, smart contracts transform online payments by offering speed, security, transparency, and cost savings. These benefits make smart contracts a compelling alternative to traditional payment systems, paving the way for the future of digital transactions.

Security benefits of smart contracts

Smart contracts offer several security benefits, leveraging the inherent features of blockchain technology. Here’s a detailed explanation of the security advantages provided by smart contracts:

1. Immutability: Once deployed on a blockchain, smart contracts become immutable. This means that the contract code and its execution history are stored on multiple nodes across the network, making it extremely difficult for any party to alter or manipulate the contract’s terms or transaction records. The immutability of smart contracts ensures that once an agreement is reached, it cannot be modified, providing a high level of security and preventing unauthorized changes.

2. Transparency and Auditability: Smart contracts operate on a transparent and public blockchain, where all transaction details are recorded and visible to participants. This transparency enables anyone to independently verify the execution and outcome of a smart contract. As a result, the entire payment process becomes auditable, reducing the potential for fraud or malicious activities. Participants can review the contract code, inspect transaction histories, and ensure that the contract behaves as intended.

3. Consensus Mechanism: Smart contracts rely on the consensus mechanism of the underlying blockchain to validate and execute transactions. Consensus algorithms, such as proof-of-work or proof-of-stake, ensure that transactions are validated by multiple nodes before being added to the blockchain. This decentralized consensus mechanism prevents fraudulent or conflicting transactions from being executed, maintaining the integrity and security of the smart contract ecosystem.

4. Elimination of Intermediaries: Smart contracts eliminate the need for intermediaries, such as banks or payment processors, in the payment process. By removing intermediaries, the security risks associated with centralized systems are significantly reduced. Intermediaries are often vulnerable to hacking, data breaches, or insider attacks. With smart contracts, payments occur directly between the involved parties, reducing the attack surface and potential points of failure.

5. Cryptographic Security: Blockchain technology relies on advanced cryptographic algorithms to secure transactions and data. Smart contracts utilize public-key cryptography, ensuring that participants have unique cryptographic keys to sign transactions and interact with the contract. Cryptography provides strong security measures, such as encryption, digital signatures, and hash functions, protecting the confidentiality, integrity, and authenticity of the payment process.

6. Trustless Execution: Smart contracts facilitate trustless execution, meaning that participants can engage in transactions without needing to trust each other explicitly. The contract’s predefined rules and conditions, encoded in the contract code, ensure that transactions are executed automatically and impartially. The decentralized and transparent nature of smart contracts, combined with cryptographic mechanisms, eliminates the need to rely on trust in counterparties, reducing the risk of fraud or manipulation.

7. Reducing Single Points of Failure: Traditional systems often have single points of failure, where a centralized server or entity holds critical data or controls the payment process. Smart contracts, operating on a distributed blockchain network, do not have a single point of failure. The contract’s code and data are replicated and stored on multiple nodes, making it highly resilient to attacks or system failures. Even if some nodes go offline, the contract can continue to function as long as a sufficient number of nodes are operational.

8. Enhanced Data Privacy: While blockchain provides transparency, smart contracts can incorporate privacy features to protect sensitive data. Techniques such as zero-knowledge proofs or private transactions can be implemented to ensure that only authorized parties can access certain information. These privacy-enhancing features allow for secure online payments while maintaining data confidentiality and complying with privacy regulations.

Smart contracts significantly enhance security by leveraging blockchain’s decentralized, transparent, and cryptographic properties. The immutability, transparency, auditability, elimination of intermediaries, and cryptographic security measures inherent in smart contracts provide robust protection against fraud, tampering, and unauthorized access, making them a secure and trustworthy solution for online payments.

How to use smart contracts for online payments?

To use smart contracts for online payments, several steps need to be followed. Here’s a detailed explanation of how to utilize smart contracts for online payments:

1. Choose a Suitable Blockchain Platform: Select a blockchain platform that supports smart contracts and is suitable for your payment needs. Ethereum is the most popular platform for smart contracts, but there are other options available, such as Binance Smart Chain, Polkadot, or Cardano. Consider factors like transaction fees, scalability, and community support when choosing a blockchain platform.

2. Define Payment Terms and Conditions: Clearly define the payment terms and conditions that you want to implement in the smart contract. This includes details such as payment amount, currency, payment schedule, and any specific conditions or requirements for the payment to be executed. Specify the rules and logic that govern the payment process.

3. Write the Smart Contract Code: Use a programming language suitable for smart contracts, such as Solidity for Ethereum, to write the code that implements the payment logic. Define functions that handle payment initiation, verification, and execution based on the defined terms and conditions. Ensure the code is secure and follows best practices to mitigate potential vulnerabilities.

4. Compile and Deploy the Smart Contract: Once the smart contract code is written, it needs to be compiled into bytecode that can be executed on the blockchain. Use a compiler or development environment provided by the chosen blockchain platform to compile the code. Then, deploy the compiled contract to the blockchain network by submitting a deployment transaction. This transaction will create a new instance of the smart contract on the blockchain.

5. Interact with the Smart Contract: To initiate a payment, participants interact with the deployed smart contract. This can be done through a user interface or programmatically using APIs or other integrations. Interacting with the contract involves invoking specific functions within the contract that handle payment-related operations. For example, there may be a function to initiate a payment, verify the payment conditions, and trigger the payment execution.

6. Fund the Contract: Before a payment can be executed, the smart contract needs to be funded with the required amount of cryptocurrency or digital tokens. Participants need to transfer the funds to the contract’s address to ensure it has the necessary balance for executing the payment when the conditions are met. The contract code should include mechanisms to handle and track the received funds.

7. Payment Execution and Settlement: The smart contract automatically executes the payment when the predefined conditions are met. The contract code verifies the fulfillment of the payment terms and initiates the transfer of funds from the contract to the intended recipient. The payment execution and settlement occur on the blockchain, providing transparency and immutability.

8. Verification and Confirmation: After the payment is executed, participants can verify the transaction details and the updated state of the contract on the blockchain. The transparent nature of blockchain allows for easy verification of payment execution and confirmation of successful transactions. Participants can access the transaction records and contract state on the blockchain explorer or through dedicated tools.

9. Event Notifications and Integration: Smart contracts can emit events during the payment process. These events can be used to notify external systems or applications about the payment status or trigger additional actions. External systems can listen to these events and integrate them into their own processes or workflows, allowing for seamless integration between smart contracts and other systems.

10. Security and Monitoring: Regularly monitor the smart contract and associated transactions to ensure the payment process operates as intended and to identify any potential security issues. Implement appropriate security measures, such as code audits, vulnerability testing, and secure key management, to safeguard the smart contract and mitigate risks.

By following these steps, you can effectively utilize smart contracts for online payments. It’s important to thoroughly test the smart contract, ensure its security, and educate all involved parties about the payment process to maximize the benefits of using smart contracts for online payments.

Also read: Answering Top 7 Burning Questions About “Smart Contracts”

Top 10 examples of Smart contracts improving security for online payment

- Reduced fraud and theft: Smart contracts are tamper-proof and cannot be altered once they are deployed on the blockchain. This makes them much more resistant to fraud and theft than traditional payment systems, which are often vulnerable to cyberattacks.

- Increased transparency: Smart contracts are stored on a public blockchain, which means that all transactions are visible to everyone. This increased transparency makes it much more difficult for fraudsters to operate, as they will be easily caught.

- Improved efficiency: Smart contracts can automate many of the manual processes involved in online payments, such as verification and reconciliation. This can lead to significant cost savings and faster processing times.

- Reduced risk of chargebacks: Smart contracts can be programmed to include terms and conditions that protect merchants from chargebacks. This can help to reduce the risk of fraud and improve merchant cash flow.

- Increased flexibility: Smart contracts can be customized to meet the specific needs of businesses and consumers. This flexibility can help to improve the security and efficiency of online payments.

- Improved trust: Smart contracts can help to build trust between businesses and consumers by providing a secure and transparent way to make payments. This can lead to increased sales and customer satisfaction.

- Global reach: Smart contracts can be used to make payments anywhere in the world, regardless of location or currency. This can help businesses to expand into new markets and reach new customers.

- Reduced costs: Smart contracts can help to reduce the costs associated with online payments, such as transaction fees and processing fees. This can save businesses money and pass those savings on to consumers.

- Increased security: Smart contracts are more secure than traditional payment systems because they are not vulnerable to many of the same cyberattacks. This can help to protect businesses and consumers from fraud and theft.

- Scalability: Smart contracts can be scaled to handle large volumes of transactions without compromising security or performance. This makes them ideal for businesses that process a high volume of payments.

What are smart contracts and how do they work?

Short 🧵 pic.twitter.com/2ktfL14zAz— 𝙶𝙰𝙱𝚈 𝙻𝙾𝚅𝙴𝚂 𝚃𝙴𝙲𝙷 🇹🇿 🇰🇪 (@gabyconscious) December 25, 2022

These are just a few of the ways that smart contracts are improving security for online payments. As technology continues to develop, we can expect to see even more innovative and secure ways to use smart contracts to make payments.