Assessing The Impact Of Rising Transaction Fees On The Future Of Web3

The advent of Web3 technology has ushered in a new era of decentralization, blockchain applications, and the promise of a trustless, transparent future. However, a persistent challenge looms on the horizon—rising transaction fees. As blockchain networks, particularly Ethereum, grapple with scalability issues, the escalating cost of transactions raises concerns about the viability of the Web3 vision. In this extensive exploration, we delve into the intricacies of rising transaction fees and their potential impact on the future trajectory of Web3.

Understanding the Rise in Transaction Fees:

1. Scalability Woes:

- Growing Demand for Web3 Services: The increasing popularity of decentralized applications (dApps), non-fungible tokens (NFTs), and decentralized finance (DeFi) platforms has led to a surge in demand for blockchain transactions. As a result, blockchain networks face scalability challenges, struggling to handle the growing volume of transactions efficiently.

- Ethereum’s Struggle: Ethereum, a prominent platform in the Web3 ecosystem, has encountered scalability bottlenecks due to its proof-of-work (PoW) consensus mechanism. This limitation impedes transaction throughput, causing congestion on the network and driving up transaction fees.

2. Competition for Block Space:

- Bid-Based Fee Mechanism: Many blockchain networks, including Ethereum, employ a bid-based fee mechanism where users compete to have their transactions included in the next block. During periods of high demand, users must bid higher fees to prioritize their transactions, leading to increased costs.

- Impact on Small Transactions: Rising transaction fees disproportionately affect small transactions, making microtransactions and everyday use cases economically unviable. This challenges the inclusivity and accessibility goals inherent in the Web3 vision.

CLICKS Revolution: the decentralised social media platform of the future!

World of CLICKS, the next generation of social media powered by Web3 technology. Let’s take a global look at how CLICKS is reinventing the social experience, security, innovation.

@clickschain #ClicksChain pic.twitter.com/NPlKMWGYP3— Merciano ALIA (@mercianoalia) January 2, 2024

The Web3 Vision and its Vulnerability:

1. Decentralization and Accessibility:

- Inclusive Financial Systems: One of the cornerstones of the Web3 vision is the creation of inclusive financial systems, providing access to financial services for individuals worldwide. However, rising transaction fees jeopardize this inclusivity, particularly for those in regions with lower economic means.

- Microtransactions and Micropayments: Web3 envisions a future where microtransactions and micropayments facilitate seamless interactions within decentralized applications. The soaring transaction fees impede this vision, hindering the potential for frictionless, low-cost transactions.

2. Empowerment through Ownership:

- NFTs and Digital Assets: Non-fungible tokens (NFTs) represent a paradigm shift in ownership, allowing individuals to truly own digital assets. However, the rising cost of minting and trading NFTs erodes the accessibility of this ownership model, limiting the democratization of digital assets.

- Impact on Gaming and Collectibles: Web3 gaming relies on NFTs for true ownership of in-game assets. The current trajectory of rising transaction fees poses challenges to the seamless trading and ownership transfer of these assets, affecting the economic incentives for players and developers alike.

3. DeFi and Decentralized Exchanges:

- Decentralized Finance (DeFi): The decentralized finance sector, a key component of Web3, aims to provide financial services without intermediaries. However, the burgeoning transaction fees diminish the appeal of DeFi platforms, as users may find it economically impractical to engage in lending, borrowing, or yield farming activities.

- Challenges for Decentralized Exchanges: Decentralized exchanges (DEXs) are pivotal in the Web3 ecosystem, facilitating peer-to-peer trading. The escalating transaction fees impact the cost-effectiveness of using DEXs, potentially driving users toward centralized exchanges for more affordable transactions.

Mitigating Transaction Fee Challenges:

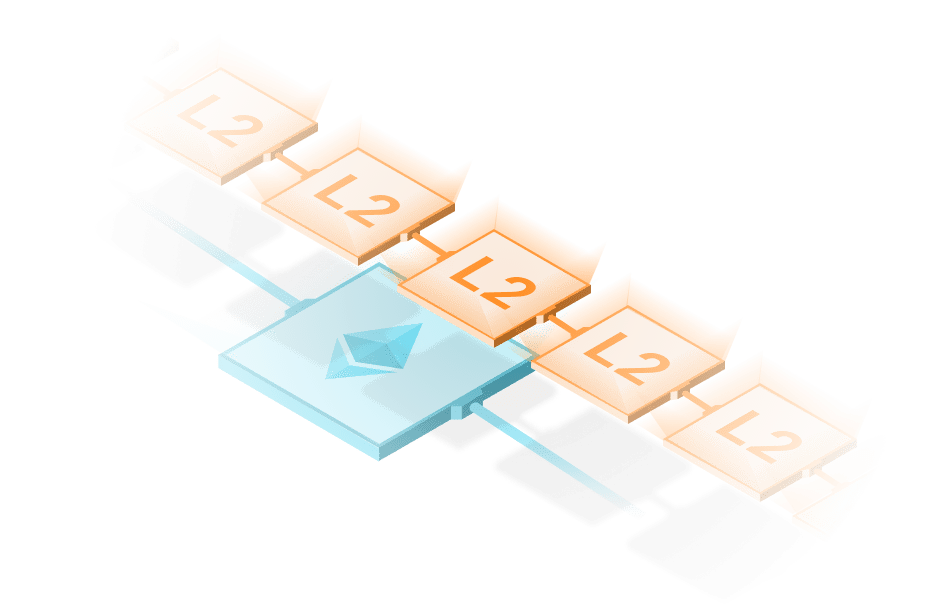

1. Layer 2 Scaling Solutions:

- Optimistic Rollups and zk-Rollups: Layer 2 scaling solutions offer off-chain processing for transactions, reducing the burden on the main blockchain. Optimistic Rollups and zk-Rollups are examples of these solutions, providing increased throughput and lower transaction fees by aggregating multiple transactions before settling on-chain.

- User Adoption and Integration: Widespread adoption of layer 2 solutions requires seamless integration into wallets, exchanges, and dApps. User-friendly interfaces and clear communication about the benefits of these solutions are essential for encouraging their adoption.

2. Ethereum 2.0 Transition:

- Proof-of-Stake (PoS) Implementation: Ethereum’s transition to Ethereum 2.0 involves a shift from proof-of-work (PoW) to PoS consensus. PoS is anticipated to significantly reduce the energy consumption and transaction fees associated with PoW, providing a more sustainable and scalable blockchain.

- Challenges and Phased Rollout: The Ethereum 2.0 transition faces challenges, including the complexity of implementation and the need for community consensus. A phased rollout is expected, and ongoing community involvement is crucial for successful adoption.

3. Alternative Blockchain Platforms:

- Binance Smart Chain, Solana, and Others: Emerging blockchain platforms, such as Binance Smart Chain and Solana, offer alternatives to networks facing scalability issues. These platforms boast higher transaction throughput and lower fees, attracting developers and users seeking more cost-effective solutions.

- Multi-Chain Ecosystems: The rise of multi-chain ecosystems allows users to choose networks that align with their specific needs, fostering competition and innovation. Cross-chain interoperability standards can further enhance the flexibility and efficiency of multi-chain solutions.

4. Governance and Fee Adjustments:

- Community-Led Governance Proposals: Active community participation in governance proposals can influence fee adjustments and other protocol changes. Open communication channels and transparent decision-making processes empower users to voice concerns and contribute to network enhancements.

- Dynamic Fee Models: Implementing dynamic fee models that respond to network conditions can optimize transaction costs. Fee-burning mechanisms, fee market algorithms, and adaptive pricing strategies contribute to more efficient and user-friendly fee structures.

5. Smart Contract Optimization:

- Gas-Efficient Coding Practices: Developers can contribute to fee mitigation by adopting gas-efficient coding practices. Optimizing smart contract execution reduces the computational resources required, resulting in lower transaction fees.

- Automated Tools and Audits: Automated tools for gas estimation and smart contract audits help identify and rectify inefficiencies in code. Regular auditing practices contribute to the overall security and efficiency of smart contracts.

6. Education and User Awareness:

- Optimizing Transaction Behavior: Educating users about gas fees, transaction timing, and gas-efficient practices empowers them to make informed decisions. User awareness campaigns, tutorials, and guides play a crucial role in optimizing transaction behavior.

- Alerts and Notifications: Integrating alerts and notifications in wallets and dApps can inform users about current network conditions and suggested gas fees. This real-time information enables users to make cost-effective decisions when interacting with the blockchain.

7. Regulatory Clarity and Collaboration:

- Engaging with Regulatory Bodies: Blockchain projects engaging with regulatory bodies to advocate for clear and supportive regulatory frameworks contributes to the legitimacy and acceptance of blockchain technology. Regulatory clarity fosters confidence among users and investors.

- Industry Collaboration: Collaborative efforts within the blockchain industry, including partnerships, knowledge sharing, and interoperability initiatives, contribute to a more robust and interconnected ecosystem. Standardizing certain processes and technologies can streamline operations and reduce redundancy.

Mitigating transaction fee challenges in blockchain networks requires a multifaceted and collaborative approach. From embracing layer 2 scaling solutions to transitioning to alternative platforms and fostering community-led governance, the path forward involves innovation, education, and user-centric strategies. As blockchain technology continues to evolve, the collective efforts of developers, users, and industry stakeholders will play a pivotal role in shaping a future where transaction fees are optimized, and blockchain networks remain accessible, efficient, and scalable.

The Path Forward: Striking a Balance:

1. Layer 2 Scaling Solutions:

- Off-Chain Scaling: Layer 2 scaling solutions, such as Optimistic Rollups and zk-Rollups, provide off-chain processing to alleviate congestion on the main blockchain. These solutions aim to enhance throughput, reduce latency, and ultimately lower transaction fees.

- User Adoption: Widespread adoption of layer 2 solutions hinges on their seamless integration into wallets, exchanges, and dApps. User-friendly interfaces and educational initiatives can drive awareness and encourage users to leverage these scaling solutions.

2. Ethereum 2.0 Transition:

- PoS Consensus: Ethereum’s transition to Ethereum 2.0, adopting a Proof-of-Stake (PoS) consensus mechanism, holds promise for scalability improvements and reduced transaction fees. PoS is expected to enhance energy efficiency and make transactions more economically viable.

- Community Engagement: The success of Ethereum 2.0 relies on ongoing community engagement and consensus. Transparent communication, regular updates, and collaboration within the Ethereum community contribute to a smoother transition.

3. Alternative Blockchain Platforms:

- Diverse Ecosystems: Exploring alternative blockchain platforms, such as Binance Smart Chain, Solana, and others, provides users and developers with diverse ecosystems. Platforms with higher throughput and lower fees offer alternatives for specific use cases.

- Interoperability Standards: Collaborative efforts to establish interoperability standards between different blockchain platforms foster a connected and efficient Web3 ecosystem. This interoperability allows users and assets to move seamlessly across diverse chains.

4. Dynamic Governance Models:

- Community-Led Decision-Making: Active community participation in governance decisions enables users to have a say in fee adjustments and protocol changes. Transparent and inclusive governance models contribute to a sense of ownership among users.

- Adaptive Fee Structures: Implementing dynamic fee models that respond to network conditions allows for optimal transaction costs. Fee-burning mechanisms, flexible pricing strategies, and adaptive algorithms contribute to more efficient fee structures.

5. User Education and Awareness:

- Optimizing User Behavior: Educational initiatives that inform users about gas fees, transaction timing, and efficient practices empower them to make cost-effective decisions. Tutorials, guides, and real-time information in wallets help users navigate the complexities of transaction fees.

- Transparent Communication: Wallets, dApps, and platforms can enhance transparency by providing clear information about current network conditions and suggested gas fees. Real-time alerts and notifications contribute to informed decision-making by users.

6. Regulatory Engagement and Collaboration:

- Advocacy for Blockchain-Friendly Policies: Engaging with regulatory bodies to advocate for clear and supportive policies creates an environment conducive to innovation. Regulatory clarity fosters confidence, attracting more users and developers to the Web3 space.

- Industry Collaboration: Collaborating within the blockchain industry, sharing knowledge, and working on interoperability initiatives contribute to a more robust and interconnected ecosystem. Standardizing certain processes and technologies reduces redundancy and enhances overall efficiency.

Top 3 ways of striking the Delicate Balance:

1. Innovation and Adaptation:

- Continuous Technological Innovation: Web3 platforms must continue to innovate, exploring new consensus mechanisms, scalability solutions, and cutting-edge technologies. A dynamic approach to technological advancement ensures adaptability to evolving challenges.

- User-Centric Design: Putting users at the center of design decisions ensures that solutions align with their needs and preferences. Platforms that prioritize user experience and inclusivity are more likely to strike a balance between functionality and accessibility.

2. Collaborative Ecosystem Building:

- Community Collaboration: Collaboration within the Web3 community, including developers, users, and stakeholders, fosters a collective effort to address transaction fee challenges. Open dialogue, shared resources, and collaborative problem-solving contribute to a thriving ecosystem.

- Interdisciplinary Collaboration: Collaboration with experts from diverse fields, including economics, computer science, and regulatory affairs, allows for a holistic approach to addressing transaction fee challenges. Interdisciplinary insights contribute to well-rounded solutions.

3. Long-Term Sustainability Focus:

- Balancing Economic Incentives: Striking a balance between sustainable economic incentives for network validators and affordable transaction costs for users is pivotal. Economic models that consider both aspects contribute to the long-term sustainability of Web3 networks.

- Environmental Considerations: As the environmental impact of blockchain technology comes under scrutiny, Web3 platforms should explore and implement eco-friendly solutions. A sustainable approach aligns with broader environmental consciousness and regulatory expectations.

The path forward in balancing Web3 transaction fees necessitates a nuanced and collaborative effort. From technological innovations and alternative platforms to user education and regulatory engagement, the strategies employed must align with the inclusive and decentralized ethos of the Web3 vision. By continually adapting, innovating, and fostering a sense of community ownership, the Web3 ecosystem can navigate the complexities of transaction fees, ensuring a sustainable, accessible, and resilient digital future.

Also, read- Top 15 Web3 Technology Related Questions You Should Know

Conclusion:

The rising transaction fees on blockchain networks, while posing challenges to the Web3 vision, also spark innovation and a collective drive to find solutions. As the Web3 community navigates the complexities of scalability and transaction costs, the journey towards a decentralized, accessible, and inclusive future continues. Striking a delicate balance between sustainability, innovation, and user accessibility is the key to ensuring that rising transaction fees do not impede the progress of Web3, but rather become a catalyst for its evolution.