In today’s fast-changing crypto world, where prices can jump or drop quickly, Cycle Traders have become some of the most trusted experts. These analysts study past price patterns to predict future movements. As of July 16, 2025, they’re sharing some bold insights about major cryptocurrencies like Bitcoin and Ethereum. Their predictions include exciting possibilities for rallies as well as warning signs to watch out for. If you’re into crypto trading or just watching the market, their insights might help you spot the next big move or avoid a costly mistake. Let’s take a closer look at what they’re seeing.

Bitcoin Cycle Outlook: Eyes on $150K

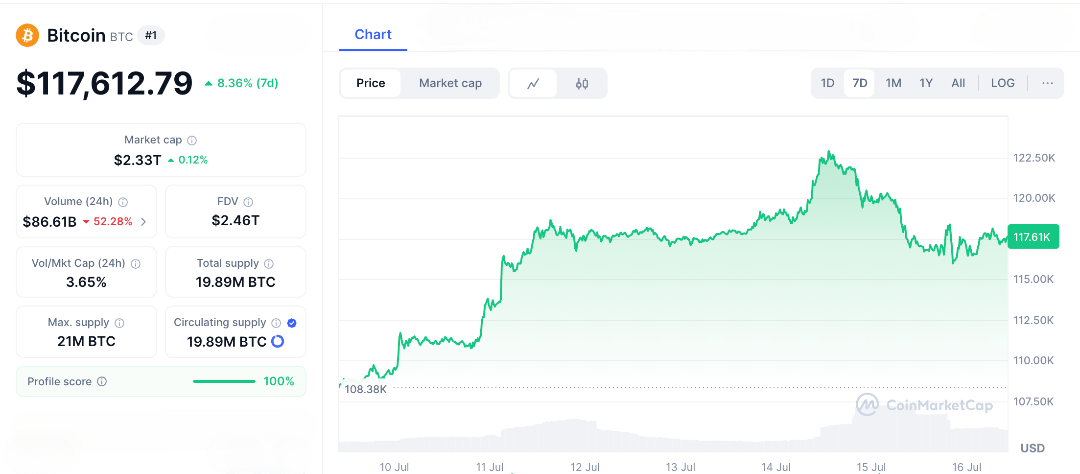

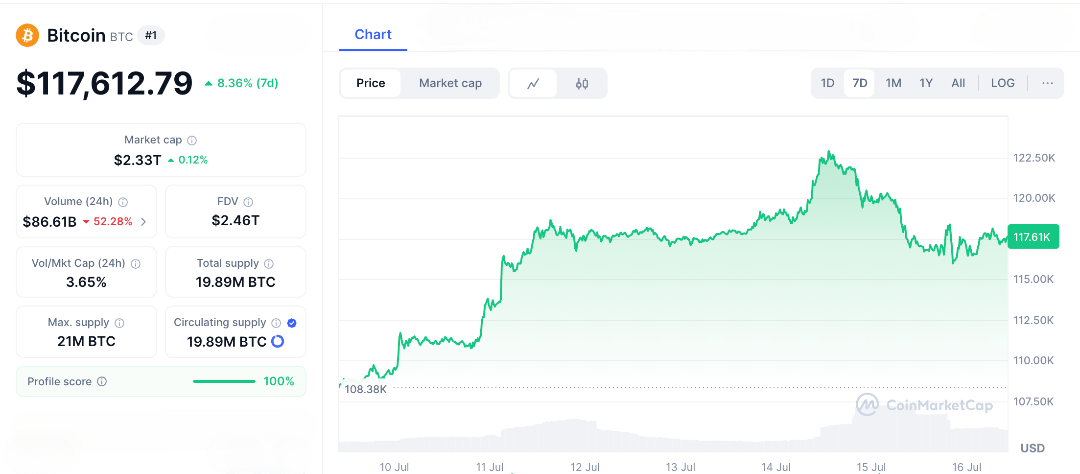

Cycle Traders rely on historical patterns, technical indicators, and market sentiment to predict price trends often studying multi-year cycles to understand where assets might be headed. For Bitcoin, the outlook is looking bullish. Currently trading around $117,612, recent chatter points to a breakout from a consolidation phase. If Bitcoin stays above the 50-week EMA, analysts believe it could climb toward $150,000. This is based on its historical four-year halving cycle, with the most recent halving in April 2024 cutting miner rewards and reducing supply often a major trigger for price surges.

Cycle Traders also highlight similarities to past post-halving rallies, with $105,000 acting as solid support and $125,000 as the next big resistance level. On top of that, institutional money is flowing in fast Bitcoin ETFs saw $2.7 billion in inflows just last week, boosting confidence. Still, some caution that a short-term dip to $110,000 could happen before the next upward move.

Could ETH Hit $4,800 Next?

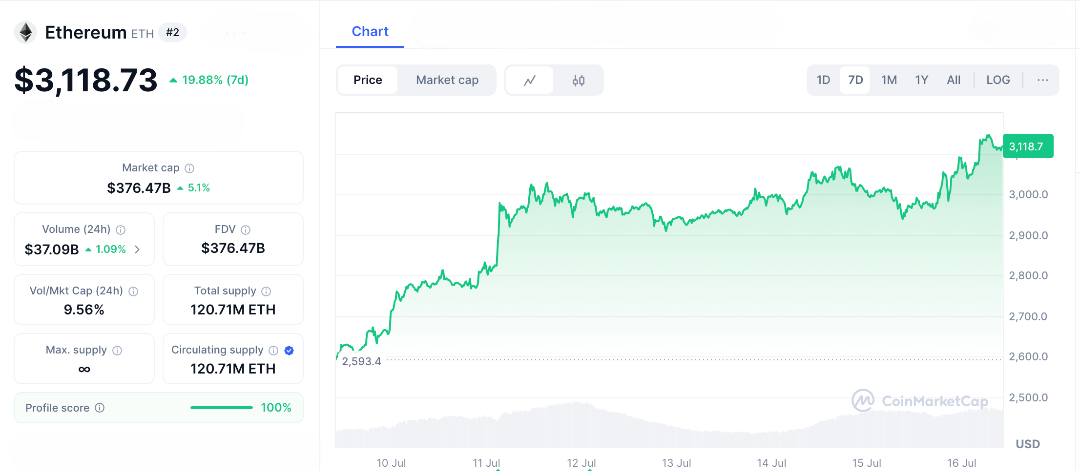

Ethereum, often called the backbone of DeFi, is firmly on the radar of Cycle Traders. Currently trading around $3,118, ETH has shown strength by breaking past the $3,200 resistance level a key sign of momentum.

On TradingView, many Cycle Traders are predicting a possible rally toward $4,800, thanks to rising adoption of Ethereum-based dApps and the recent approval of Ethereum ETFs. The numbers back it up active addresses are up 8% to 1.2 million, and gas fees are stabilising, which points to a healthy, active network.

But it’s not all smooth sailing. If ETH dips below $3,300, traders warn it could fall to the next support around $3,100. Also, while Ethereum’s smart contract dominance is still strong, the rise of competitors like Solana is keeping everyone alert. The ongoing AI hype pushing projects like TAO is also benefiting Ethereum, especially as it’s the go-to platform for building intelligent, decentralised apps.

Solana and Cardano Catch Cycle Traders’ Attention

Cycle Traders aren’t just watching Bitcoin and Ethereum they’ve got their eyes on altcoins too, especially Solana and Cardano.

Solana, currently priced at $162, is gaining serious traction. Traders believe that if it breaks through the $175 resistance, we could see it race toward $300. A big reason? Its ecosystem is booming transaction volume is up 32%, and big-name partners like VanEck are jumping on board.

Cardano, sitting around $0.7472, is showing early signs of a comeback. Cycle Traders are seeing a classic double-bottom pattern, which often signals a trend reversal. If adoption of its Hydra scaling solution picks up, ADA could climb to $1. Altcoins are risky business. While they offer big upside, they’re also more vulnerable especially with Bitcoin’s dominance at 54%, which can suck the life out of smaller coins during major BTC rallies. For altcoin traders, the key is timing and keeping a close eye on market sentiment.

Cycle Trading Insights

While there’s a lot of excitement around Cycle Traders’ predictions, it’s important to remember that crypto markets are very sensitive to global events, regulations, and changes in online sentiment. Recently, $1.2 billion in liquidations happened within 24 hours, showing that risky bets can fail quickly. Regulatory uncertainty, especially concerning stablecoins, is another risk. If new laws come out suddenly, they could slow down even the strongest rally.

Despite these risks, Cycle Traders have a good track record. They are the ones who noticed Bitcoin’s typical 80% gains after halving events and Ethereum’s strong connection to DeFi total value locked (TVL). Their insights are fueling debates and grabbing the attention of retail investors, which often boosts momentum.

For investors, these predictions are useful guides but not guarantees. While Bitcoin and Ethereum look promising, smart traders wait for confirmations, like Bitcoin holding above $120K or Ethereum surpassing $3,500, before investing. Altcoins can offer big gains, but they are also more volatile, requiring extra caution. Cycle Traders provide valuable insights, but in the crypto world, it’s crucial to stay flexible and informed rather than just chasing the next big opportunity.

FAQs

- Who are Cycle Traders?

Cycle Traders are market analysts who study historical price patterns and technical indicators to forecast cryptocurrency movements, focusing on repeating market cycles.

- What are Cycle Traders predicting for Bitcoin?

Cycle Traders see Bitcoin, at $118,870, potentially reaching $150,000 if it holds above $120,000, driven by post-halving cycles and ETF inflows. However, this is speculative.

- What’s the outlook for Ethereum from Cycle Traders?

Cycle Traders predict Ethereum, at $3,450, could hit $4,800 if it breaks $3,500, fueled by ETF approvals and DeFi growth, with support at $3,100.

- Which altcoins are Cycle Traders watching?

Cycle Traders highlight Solana ($160, targeting $300) and Cardano ($0.45, eyeing $0.65), citing ecosystem growth but warning of volatility risks.

- What risks should I consider with these forecasts?

Risks include market volatility, regulatory changes, and over-leveraged positions, with $1.2 billion in recent liquidations signalling potential corrections, per market data.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].