Zebec Network, a decentralized infrastructure platform launched in 2021, is transforming how real-world value flows through blockchain technology. On May 1, 2025, Zebec announced its certification as a member of Circle’s Alliance Program, integrating USDC as the default stablecoin across its product suite. This partnership, combined with a $50,000 buyback of 50 million ZBCN tokens, sparked a 30% price surge in 24 hours, reflecting strong market enthusiasm. Operating primarily on the Solana blockchain, Zebec’s innovative offerings—real-time payroll, crypto debit cards, and a forthcoming DePIN point-of-sale (PoS) terminal—are positioning it as a leader in bridging Web2 and Web3 finance. This article explores Zebec’s recent developments, their implications, and its growing influence.

Circle Alliance Program: A Game-Changing Partnership

Zebec’s entry into Circle’s Alliance Program marks a significant milestone. Circle, the issuer of USDC, has been a key supporter of Zebec since its early days, with Circle Ventures among its initial investors. The partnership cements USDC as the backbone of Zebec’s ecosystem, powering products like the Zebec Carbon Card and real-time payroll services. According to Zebec’s announcement, “Circle Ventures was one of our earliest backers, and USDC powers our entire product suite—from our Zebec Cards to payroll”.

The Circle Alliance Program connects Zebec to a global network of organizations focused on advancing financial inclusion through stablecoins and Web3 technology. Members gain access to Circle’s expertise, webinars, and collaborative opportunities, enhancing Zebec’s ability to innovate and scale. This partnership aligns with Zebec’s vision of creating a future where money moves freely, reducing reliance on traditional financial intermediaries.

Token Buyback and Market Impact

Alongside the Circle announcement, Zebec initiated a $50,000 buyback of 50 million ZBCN tokens, funded by revenue from its card program. This move underscores Zebec’s commitment to deflationary tokenomics, designed to increase ZBCN’s value by reducing its total supply over time. The ZBCN token serves as both a utility and governance token, enabling holders to vote on protocol decisions and access premium features.

The market responded swiftly, with ZBCN surging 30% in 24 hours and 53% over a week as can be seen in the chart above. As of May 19, 2025, ZBCN trades at approximately $0.001826, with a market cap of $144.99 million and a 24-hour trading volume of $9.02 million. The token’s circulating supply is 76.96 billion, representing 77% of its total supply of 99.99 billion.

Innovative Products Driving Adoption

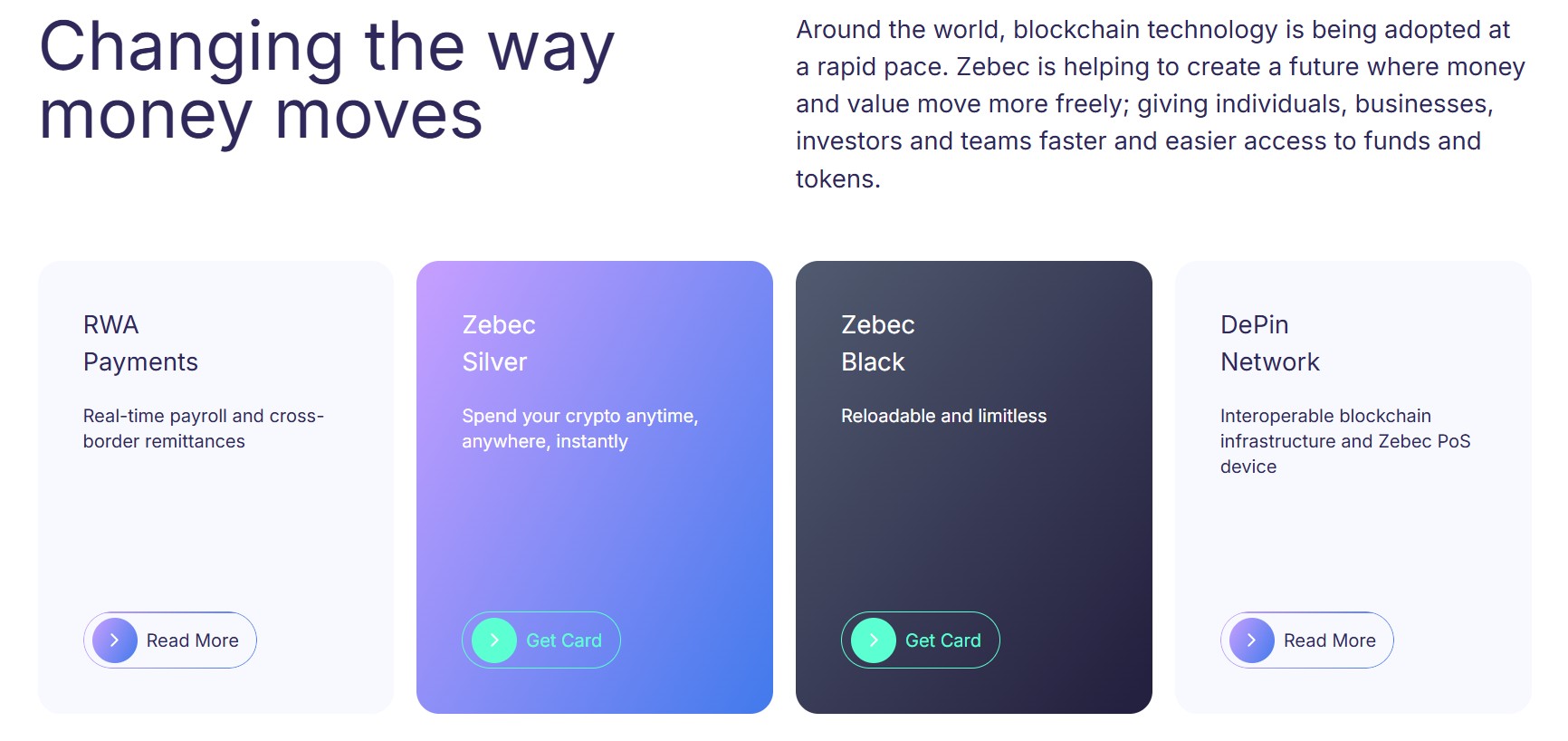

Zebec Network’s product suite is at the heart of its growing influence. Key offerings include:

-

Real-Time Payroll: Zebec’s continuous payment technology allows employees to receive salaries by the second, offering flexibility and eliminating traditional payrun delays. Employers can pause, cancel, or adjust payment streams instantly.

-

Zebec Carbon Card: Launched in March 2025 with Mastercard, this crypto debit card enables users to spend digital assets with zero fees and a $10,000 daily limit. Available in the UK and 26 European countries, it is set to expand to the US, Latin America, and Asia.

-

ZePIN PoS Terminal: Zebec is developing a DePIN-based PoS device, ZePIN, to facilitate real-time USDC payments in retail settings, generating significant community buzz.

-

Treasury Management: Zebec provides tools for Web3 companies to manage digital assets, streamlining real-time crypto payments and accounting.

These products bridge crypto and fiat systems, serving hundreds of Web2 and Web3 companies and running thousands of continuous payment streams.

Solana Ecosystem and Industry Context

Zebec’s integration with Solana, a blockchain known for its speed and low costs, enhances its scalability and appeal. Solana’s ecosystem is shifting from meme-driven projects to utility-focused protocols, with Zebec’s crypto debit card cited as a prime example of real-world applicability. In April 2025, research highlighted Zebec’s role in Solana’s growing institutional interest, signaling a maturing blockchain sector.

Solana’s total value locked (TVL) reached $8.6 billion in Q4 2024, with daily decentralized exchange volumes averaging $3.3 billion, creating a fertile environment for projects like Zebec. Zebec’s multi-chain expansion to Ethereum and BNB Chain further broadens its reach, positioning it as a versatile financial infrastructure provider.

Community Engagement and Sentiment

Zebec’s community is highly active, particularly on X, where posts reflect bullish sentiment. An X post from official channel of Zebec Network @Zebec_HQ celebrated the Circle partnership, while community discussions highlight excitement for the ZePIN PoS terminal. A live AMA on May 7, 2025, featured executives from Paybridge, Zebec’s recently acquired US payroll company, discussing global payroll redesign.

The community’s optimism is bolstered by Zebec’s history as a top mover on exchanges like Gate.io, KuCoin, and Bybit, where ZBCN/USDT pairs see high trading volumes.

While Zebec’s recent developments are promising, the cryptocurrency market is inherently volatile. The 30% price surge may attract speculative trading, potentially leading to corrections. Regulatory uncertainties, particularly around stablecoins and DePIN, could impact Zebec’s growth. Investors should conduct thorough research and exercise caution, as highlighted by 99Bitcoins, which notes crypto’s high-risk nature.

Future Outlook

Zebec’s strategic initiatives position it for sustained growth. The Circle partnership enhances its credibility and access to resources, while the ZePIN PoS terminal could disrupt retail payments. Zebec’s acquisition of Paybridge in 2023 and potential future M&A deals, as hinted in a Medium post, suggest an aggressive expansion strategy.

As Solana continues to prioritize utility, Zebec’s focus on real-world applications aligns with industry trends. However, maintaining innovation and user trust will be critical in a competitive landscape with rivals like Superfluid and Sablier.

Zebec Network’s recent milestones—joining Circle’s Alliance Program, executing a token buyback, and advancing its product suite—underscore its potential to redefine financial infrastructure. The 30% ZBCN price surge reflects market confidence in Zebec’s vision of seamless, blockchain-powered value flows. With strong backing from Circle, Coinbase, and Solana Ventures, and a growing presence in Solana’s utility-driven ecosystem, Zebec is poised to bridge traditional and decentralized finance. Investors and businesses should monitor Zebec’s progress, particularly the ZePIN launch, while remaining mindful of crypto’s volatility and regulatory challenges.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.