Top 10 Most Popular Smart Contracts Security Challenges

Smart contracts are self-executing agreements written in code that automatically execute predefined actions when specific conditions are met. They are a key component of blockchain technology and enable decentralized, trustless transactions between parties without the need for intermediaries.

Traditional contracts require intermediaries such as lawyers, banks, or brokers to ensure compliance and facilitate the execution of agreements. Smart contracts, on the other hand, leverage the decentralized nature of blockchain networks to automate and enforce contract terms, removing the need for intermediaries.

Smart contracts are typically built on blockchain platforms like Ethereum, which provide a programmable infrastructure to support their execution. Ethereum, specifically, introduced the concept of Turing-complete smart contracts, meaning they can perform any computation that can be expressed algorithmically.

Here’s how smart contracts work:

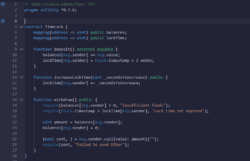

1. Code Creation: A smart contract begins with the creation of its code, which is typically written in programming languages like Solidity for Ethereum. The code outlines the terms, conditions, and actions to be executed when specific conditions are met.

2. Deployment: Once the code is written, it is compiled and deployed onto the blockchain network. This creates a unique address for the smart contract, which serves as its identifier and allows interaction with it.

3. Contract Invocation: Parties involved in the contract interact with it by sending transactions to its address. These transactions contain the necessary data and instructions to trigger the execution of the smart contract.

4. Condition Verification: The smart contract’s code is executed on the blockchain network, and the predefined conditions within the contract are verified against the provided data. This ensures that all parties adhere to the agreed-upon terms.

5. Automatic Execution: If the conditions are met, the smart contract automatically executes the predefined actions encoded within its code. These actions can range from transferring digital assets (cryptocurrencies, tokens) to updating the state of other smart contracts or triggering external events.

6. Immutability and Transparency: Once a smart contract is deployed on the blockchain, its code and execution history are immutable and transparent. This means that the contract’s logic cannot be altered or tampered with, ensuring the integrity of the agreement and providing transparency to all participants.

Challenge 2️⃣

👉Paying someone now requires more info than just a 20-byte address.

Wallet updates are needed to address concerns such as tracking ETH transfers from both EOAs and smart contracts, and accommodating apps relying on immutable address ownership.

4/

— Dr.DODO|We’re Hiring! (@DodoResearch) June 13, 2023

Importance of Security in Smart Contracts

Security is of paramount importance in smart contracts due to their nature as self-executing agreements operating on a decentralized blockchain network. Smart contracts handle valuable digital assets, execute financial transactions, and govern critical operations. Therefore, ensuring the security and integrity of smart contracts is crucial to prevent fraud, protect assets, and maintain trust among participants. Here are several key reasons why security is essential in smart contracts:

1. Trustworthiness: Smart contracts aim to replace traditional intermediaries with a decentralized system that participants can trust. Security measures are necessary to ensure that the terms and conditions encoded in the smart contract will be faithfully executed without manipulation or unauthorized access.

2. Immutability: Once a smart contract is deployed on the blockchain, its code and execution history become immutable. It is essential to ensure that the code is secure and free from vulnerabilities because any bugs or weaknesses in the code cannot be easily modified or fixed after deployment.

3. Asset Protection: Smart contracts often handle valuable digital assets such as cryptocurrencies, tokens, or intellectual property rights. Security measures must be implemented to safeguard these assets from unauthorized access, theft, or fraudulent activities.

4. Vulnerability Mitigation: Smart contracts are subject to vulnerabilities that can be exploited by malicious actors. One example is the “reentrancy” vulnerability, where an attacker repeatedly calls back into a contract before the previous call finishes, potentially draining funds or causing undesired behavior. Robust security practices and code audits are necessary to identify and mitigate such vulnerabilities.

5. Privacy: While blockchain technology provides transparency, some smart contracts may involve sensitive information. Proper security measures must be in place to protect the privacy and confidentiality of data within smart contracts, ensuring that only authorized parties have access to the required information.

6. External Integration: Smart contracts may interact with external systems or oracles to gather real-world data or trigger actions. Ensuring the security of these integrations is critical to prevent tampering, unauthorized access, or the injection of false information that could compromise the accuracy and reliability of the smart contract’s execution.

7. Code Audits: Smart contracts should undergo rigorous code audits by security experts to identify and mitigate vulnerabilities. Auditing helps identify issues such as buffer overflows, input validation problems, or insecure cryptographic algorithms that could expose the contract to attacks.

8. Penetration Testing: Performing penetration testing on smart contracts can help identify potential weaknesses or vulnerabilities by simulating real-world attack scenarios. This proactive approach helps discover and address security flaws before deployment.

9. Standardization and Best Practices: Establishing standardized security practices and coding guidelines for smart contracts can help promote security awareness and ensure a consistent level of security across different contracts. Best practices such as secure coding patterns, use of established cryptographic libraries, and adherence to established security standards can significantly enhance the security of smart contracts.

10. Continuous Monitoring: Once a smart contract is deployed, continuous monitoring is crucial to detect any anomalies or suspicious activities. Real-time monitoring and auditing tools can help identify potential security breaches, abnormal transactions, or unexpected behavior in smart contracts.

In summary, the importance of security in smart contracts cannot be overstated. Robust security measures, code audits, penetration testing, and adherence to best practices are necessary to protect assets, ensure the trustworthiness of the contract’s execution, and safeguard the integrity of the blockchain ecosystem. By prioritizing security, smart contracts can unlock their full potential as a secure and efficient alternative to traditional contract management systems.

Also read: How Smart Contracts Can Improve Security For Online Payments

Fundamentals of Smart Contracts and Vulnerabilities

1. Decentralization: Smart contracts are executed on decentralized blockchain networks, removing the need for intermediaries and enabling peer-to-peer interactions. This decentralization ensures that the execution of contracts is not controlled by a single entity, enhancing trust and transparency.

2. Self-execution: Smart contracts automatically execute predefined actions when specific conditions are met. The contract’s code defines the terms, conditions, and actions to be performed, and once these conditions are verified on the blockchain, the contract executes the actions without the need for manual intervention.

3. Immutability: Once deployed on the blockchain, smart contracts become immutable, meaning their code and execution history cannot be altered. This immutability ensures that the contract’s terms and conditions cannot be tampered with, providing security and trust to the involved parties.

4. Trustless Environment: Smart contracts leverage cryptographic algorithms and consensus mechanisms to establish trust in the absence of trusted intermediaries. The blockchain network validates and verifies the execution of smart contracts, eliminating the need to trust a central authority.

5. Transparency: Smart contracts operate in a transparent manner, as all transactions and actions performed within the contract are recorded on the blockchain. This transparency allows participants to view and verify the contract’s execution, ensuring fairness and reducing the potential for disputes.

Vulnerabilities in Smart Contracts:

1. Code Vulnerabilities: Smart contracts are typically written in programming languages like Solidity, and coding errors can lead to vulnerabilities. Common vulnerabilities include buffer overflow, integer overflow/underflow, race conditions, and improper input validation. These coding errors can allow attackers to exploit the contract’s logic and manipulate its execution.

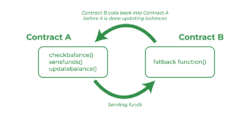

2. Reentrancy Attacks: A reentrancy attack occurs when a malicious contract repeatedly calls back into the target contract before the previous call completes. This can be used to drain funds from the contract or cause unexpected behavior. Proper design and implementation of functions, such as using the “checks-effects-interactions” pattern, can mitigate this vulnerability.

3. Front-running: Front-running occurs when an attacker intercepts and manipulates a transaction between two parties by inserting their own transaction with higher fees. This can affect the order of execution and potentially lead to financial losses or unfair advantages. Mitigation strategies include the use of mechanisms like commit-reveal schemes or using on-chain randomness to ensure fairness.

4. Oracle Exploitation: Smart contracts may rely on external data sources or oracles to obtain real-world information. If these oracles are compromised or provide incorrect data, the contract’s execution may be manipulated. It is crucial to use trusted oracles and implement mechanisms to verify and validate the data received from external sources.

5. Governance Vulnerabilities: Smart contracts that incorporate governance mechanisms to allow for upgrades or parameter changes can be vulnerable if not properly implemented. Poorly designed governance systems or centralized control over contract upgrades can lead to unauthorized changes or manipulation of the contract’s behavior.

6. Denial-of-Service (DoS) Attacks: Smart contracts can be targeted with DoS attacks by overwhelming them with a large number of transactions or by executing computationally expensive operations. This can result in increased gas fees, delays in transaction execution, or even rendering the contract non-functional.

7. Privacy Concerns: While blockchain provides transparency, it can also raise privacy concerns. If sensitive data is stored or processed within a smart contract, unauthorized access or exposure of this data can lead to privacy breaches. Care must be taken to handle and protect sensitive information properly.

Addressing Vulnerabilities:

To address vulnerabilities in smart contracts, several best practices should be followed:

1. Code Audits: Smart contracts should undergo thorough code audits by security experts to identify and address vulnerabilities, coding errors, and potential attack vectors.

2. Formal Verification: Using formal verification methods can mathematically prove the correctness of the

smart contract’s code, ensuring that it adheres to the intended behavior.

3. Secure Development Practices: Following secure coding practices, such as input validation, proper exception handling, and avoiding known vulnerabilities, reduces the likelihood of introducing security flaws.

4. Testing and Penetration Testing: Conducting comprehensive testing, including unit testing, integration testing, and penetration testing, helps identify and mitigate vulnerabilities before deployment.

5. Secure Oracles: Carefully selecting trusted oracles and implementing data validation and verification mechanisms can help ensure the integrity and accuracy of external data sources.

6. Upgradable Contracts: If contracts include upgradability mechanisms, they should have proper governance processes to prevent unauthorized changes and ensure transparency and consensus among participants.

7. Continuous Monitoring: Implementing real-time monitoring and alert systems can help detect and respond to anomalies, suspicious activities, or potential security breaches.

8. Security Awareness: Promoting security awareness among developers, users, and participants involved in smart contracts can help mitigate vulnerabilities and enhance the overall security posture.

By implementing these practices, developers and participants can strengthen the security of smart contracts, reduce the risk of vulnerabilities, and enhance the trustworthiness of the blockchain ecosystem.

Also read: Answering Top 7 Burning Questions About “Smart Contracts”

Top 10 Smart Contract Security Challenges

Smart contracts are self-executing contracts that are stored on a blockchain. They are used to automate agreements between parties and to create decentralized applications. However, smart contracts are not immune to security vulnerabilities. Here are the top 10 smart contract security challenges:

- Reentrancy attacks. Reentrancy attacks occur when a contract calls another contract, and the second contract calls back to the first contract before the first contract has finished executing. This can allow an attacker to execute the same function multiple times, or to drain the funds from the contract.

- Access control vulnerabilities. Access control vulnerabilities occur when contracts do not properly restrict who can access certain functions or data. This can allow attackers to steal funds or data from the contract.

- Logic errors. Logic errors occur when there are mistakes in the code of a contract. This can allow attackers to exploit the contract and steal funds or data.

- Integer overflow and underflow. Integer overflow and underflow occur when a contract tries to perform mathematical operations on numbers that are too large or too small. This can cause the contract to crash or to behave unexpectedly, which can allow attackers to exploit the contract.

- Time-based attacks. Time-based attacks occur when an attacker exploits the fact that contracts are deterministic. This means that if an attacker knows the state of a contract at a certain time, they can predict the state of the contract at a future time. This can be used to steal funds from the contract or to execute malicious code.

- Malicious code. Malicious code can be injected into contracts through a variety of ways, such as through user input or through smart contracts that are deployed to the blockchain. This malicious code can then be used to steal funds or data from the contract.

- Insufficient testing. Insufficient testing is a major cause of smart contract vulnerabilities. Contracts are often not properly tested before they are deployed to the blockchain, which can leave them vulnerable to attack.

- Auditing. Auditing is a process of having a third party review the code of a contract to look for vulnerabilities. However, audits are not always effective, and they can be expensive.

- Security best practices. Not following security best practices is a major cause of smart contract vulnerabilities. These best practices include things like using secure coding practices, using secure libraries, and storing secrets securely.

- Lack of awareness. Lack of awareness of smart contract security is a major problem. Many developers are not aware of the security risks associated with smart contracts, and they do not take the necessary steps to protect their contracts.

These are just some of the top smart contract security challenges. It is important to be aware of these challenges and to take steps to mitigate them. By following security best practices and by having your contracts audited, you can help to protect your contracts from attack.

How to Protect Your Smart Contracts

There are a number of things you can do to protect your smart contracts from attack:

- Use secure coding practices. When writing your smart contracts, use secure coding practices such as input validation, output sanitizing, and error handling.

- Use secure libraries. There are a number of secure libraries available for smart contracts. Use these libraries to help you implement security features such as access control and encryption.

- Store secrets securely. Do not store secrets, such as private keys, in your smart contracts. Instead, store them in a secure location, such as a hardware wallet.

- Get your contracts audited. Have your contracts audited by a security professional to help identify and fix vulnerabilities.

- Stay up-to-date on security best practices. The security landscape is constantly changing. Stay up-to-date on the latest security best practices to help protect your smart contracts.

By following these tips, you can help to protect your smart contracts from attack.

Importance of smart contracts for the economy

Smart contracts play a significant role in revolutionizing the economy by introducing numerous benefits and transformative potential. Here are several key reasons why smart contracts are important for the economy:

1. Efficiency and Cost Reduction: Smart contracts automate processes that traditionally require manual intervention, reducing the time and effort needed for contract execution. By eliminating intermediaries and automating tasks, smart contracts streamline operations, resulting in cost savings for businesses and individuals. This increased efficiency can lead to enhanced productivity and economic growth.

2. Trust and Transparency: Smart contracts operate on decentralized blockchain networks, leveraging cryptography and consensus mechanisms to establish trust among participants. The transparent nature of blockchain technology enables all parties to view and verify the terms and execution of smart contracts, reducing the need for trust in potentially unreliable intermediaries. This increased trust fosters secure transactions and encourages collaboration among businesses and individuals.

3. Disintermediation: Traditional economic systems often rely on intermediaries such as banks, lawyers, brokers, or notaries to facilitate transactions and enforce agreements. Smart contracts eliminate the need for these intermediaries, allowing parties to engage in direct peer-to-peer interactions. By removing intermediaries, smart contracts reduce associated fees, delays, and bureaucracy, making transactions more efficient, accessible, and cost-effective.

4. Global Accessibility: Smart contracts are not bound by geographical limitations or traditional banking hours. They operate 24/7, allowing for borderless transactions and enabling participation from anyone with an internet connection. This global accessibility can promote economic inclusivity, opening up new opportunities for individuals and businesses worldwide, particularly in regions with limited access to traditional financial services.

5. Improved Security: Smart contracts leverage cryptography and decentralized networks to enhance security and reduce the risk of fraud or manipulation. The immutability of blockchain ensures that once a smart contract is deployed, its code and execution history cannot be altered. The secure and tamper-proof nature of smart contracts instills confidence in economic transactions, encouraging greater participation and reducing risks associated with traditional contract enforcement.

6. Innovation and New Business Models: Smart contracts enable the development of innovative business models and decentralized applications (DApps). Through programmable contracts, businesses can create novel ways of exchanging value, such as tokenized assets, decentralized finance (DeFi), non-fungible tokens (NFTs), and more. These innovations drive economic growth, foster entrepreneurship, and unlock new avenues for investment and fundraising.

7. Supply Chain Optimization: Smart contracts have transformative potential in supply chain management. By automating and tracking transactions, logistics, and inventory management, smart contracts improve transparency, traceability, and efficiency in the supply chain. This can reduce costs, mitigate fraud, enhance product quality, and optimize inventory, ultimately benefiting businesses, consumers, and the overall economy.

8. Financial Inclusion: Smart contracts have the potential to address financial inclusion challenges by providing access to financial services for the unbanked and underbanked populations. Through decentralized finance (DeFi) applications, individuals can access lending, borrowing, savings, and investment opportunities without relying on traditional financial institutions. This fosters economic empowerment, reduces inequalities, and drives financial inclusion globally.

9. Streamlined Compliance and Auditing: Smart contracts can automate compliance processes by embedding regulatory requirements directly into the contract’s code. This ensures that transactions and operations comply with relevant laws and regulations. Additionally, the transparency of smart contracts simplifies auditing processes, as all contract activities are recorded on the blockchain, enabling easy verification and regulatory oversight.

10. Economic Efficiency through Smart Contract Ecosystems: Smart contracts facilitate the development of decentralized ecosystems and platforms, where multiple contracts can interact and interoperate. These ecosystems enable interoperability, synergies, and collaboration among different participants and contracts, creating a vibrant economic ecosystem where value can flow seamlessly.

In summary, smart contracts bring efficiency, trust, security, and innovation to the economy. By automating and streamlining transactions, reducing costs, fostering trust, and unlocking new economic possibilities, smart contracts have the potential to drive economic growth, empower individuals, improve financial inclusion, and reshape traditional industries.

Also read: Top 10 Ways Smart Contracts Can Revolutionize Digital Banking

Future of Smart Contracts

The future of smart contracts is poised to be transformative, with potential advancements and widespread adoption across various industries. Here are several key aspects that highlight the future of smart contracts:

1. Increased Adoption: As awareness and understanding of blockchain technology grow, we can expect increased adoption of smart contracts. Industries such as finance, supply chain management, healthcare, real estate, and more are exploring the potential of smart contracts to streamline processes, enhance transparency, and reduce costs. Governments and regulatory bodies are also recognizing the benefits of smart contracts, leading to potential regulatory frameworks that support their adoption.

2. Integration with Emerging Technologies: Smart contracts are likely to integrate with other emerging technologies, such as Internet of Things (IoT), artificial intelligence (AI), and decentralized finance (DeFi). This integration can enable innovative use cases, such as automated insurance claims processing using IoT data, AI-powered smart contracts for complex negotiations, or decentralized financial instruments and lending protocols in the DeFi space.

3. Cross-Chain Interoperability: Currently, smart contracts are predominantly developed and executed on specific blockchain platforms like Ethereum. In the future, we can expect advancements in cross-chain interoperability, allowing smart contracts to interact seamlessly across different blockchain networks. This interoperability will enable greater flexibility, scalability, and connectivity, unlocking new opportunities for collaboration and value exchange.

4. Enhanced Privacy Features: While blockchain offers transparency, privacy remains a concern for certain applications. Future advancements in privacy-preserving technologies, such as zero-knowledge proofs and secure multi-party computation, may enable smart contracts to handle sensitive data while maintaining privacy. This could open doors for applications in healthcare, identity management, and sensitive financial transactions.

5. Smart Legal Contracts: Smart contracts have the potential to merge with traditional legal contracts, creating “smart legal contracts” that embed legal terms and automatically enforce them through self-executing code. This integration could streamline contract management, enhance compliance, and enable automated dispute resolution. Smart legal contracts could also enable complex contractual relationships with dynamic conditions, reducing the need for manual contract amendments.

6. Standards and Interoperability: As smart contract adoption grows, there will be a need for standards and interoperability frameworks to ensure compatibility and seamless integration across different smart contract platforms. Efforts are already underway to establish common standards, such as the ERC-20 standard for tokens on Ethereum. These standards will promote interoperability, enhance collaboration, and simplify development processes.

7. Improved Security Measures: As the understanding of smart contract vulnerabilities deepens, there will be increased focus on enhancing security measures. Advances in formal verification methods, static analysis tools, and code auditing processes will help identify and mitigate vulnerabilities more effectively. Additionally, the emergence of dedicated smart contract security platforms and services will further enhance the security of smart contracts.

8. Regulatory Frameworks: The future of smart contracts will likely involve the development of regulatory frameworks to address legal and compliance aspects. Governments and regulatory bodies are exploring ways to ensure the proper functioning, enforceability, and protection of parties involved in smart contract transactions. Clear regulations will provide legal certainty, encourage wider adoption, and address potential concerns such as consumer protection, data privacy, and anti-money laundering measures.

9. Cross-Industry Collaboration: As smart contract adoption expands, we can expect increased collaboration between different industries. Sectors that traditionally operate in silos, such as finance, logistics, and healthcare, may come together to leverage the benefits of smart contracts and create interconnected ecosystems. This collaboration will foster innovation, efficiency, and value creation across multiple sectors.

10. Decentralized Governance: The future may witness the emergence of decentralized governance models for smart contracts and blockchain networks. Decentralized autonomous organizations (DAOs) can utilize smart contracts to enable transparent decision-making, voting mechanisms, and community governance. These models will empower participants and stakeholders to have a direct say in the evolution and management of smart contracts and blockchain networks.

In conclusion, the future of smart contracts is promising, with increased adoption, integration with emerging technologies, enhanced privacy features, improved security measures, regulatory frameworks, and cross-industry collaboration. As these developments unfold, smart contracts are likely to reshape industries, streamline processes, foster innovation, and drive economic growth in the years to come.